While 2025 is proving to be a year of mixed signals for U.S. private equity, the overarching trend is one of gradual stabilization. After an uneven start marked by tariffs and delayed rate cuts, activity improved in the second half of the year, giving way to anticipated momentum as the market moves into 2026.

Despite ongoing macroeconomic uncertainty, the outlook for private markets remains positive. According to Preqin, private markets are projected to grow from approximately $13 trillion today to more than $20 trillion by 2030, reaffirming the sector’s long-term appeal.

With inflation moderating and borrowing costs expected to trend lower, the market is entering a period that favors disciplined execution and operational value creation, areas where middle-market managers have historically excelled.

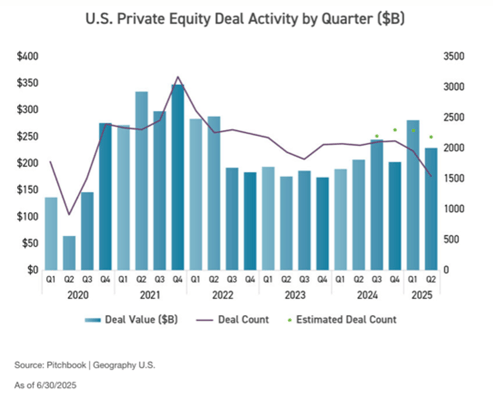

The first half of 2025 reflected the push and pull of competing forces. Early optimism gave way to caution as tariff concerns and interest rate uncertainty weighed on sentiment. However, by midyear, conditions began to stabilize. PitchBook data shows that while deal flow in Q2 2025 declined 5% from Q1, it was 6.3% higher year over year compared with Q2 2024, a sign that overall momentum is building.

Large-scale buyouts were less common, but add-on acquisitions and smaller platform transactions continued. Middle-market deals, typically ranging from $25 million to $1 billion, remained the core of private equity activity. With lower leverage and a focus on operational performance, these transactions continue to drive consistent value creation.

Looking ahead, a more predictable policy environment and easing credit conditions are expected to fuel deal flow through 2026. Strategic buyers are re-entering the market, and sponsors are becoming more flexible on valuations, laying the groundwork for a more balanced transaction landscape.

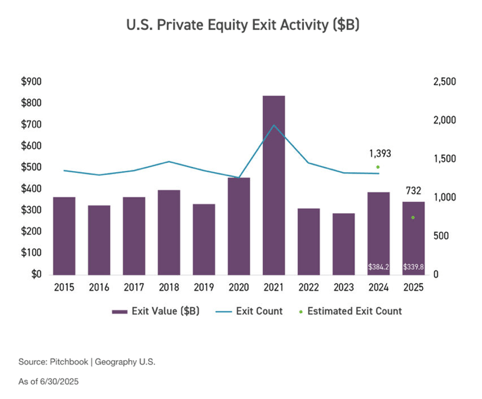

Exit markets gained traction in late 2025 as both strategic acquirers and corporate buyers returned. According to Preqin, private equity exit values reached 69% year over year in the first half of 2025, with exit counts up 18%.

Realizations are critical to private equity as they generate distributions to LPs and free capital for redeployment. As M&A activity normalizes and IPO markets reopen, the flow of distributions is expected to strengthen further in 2026.

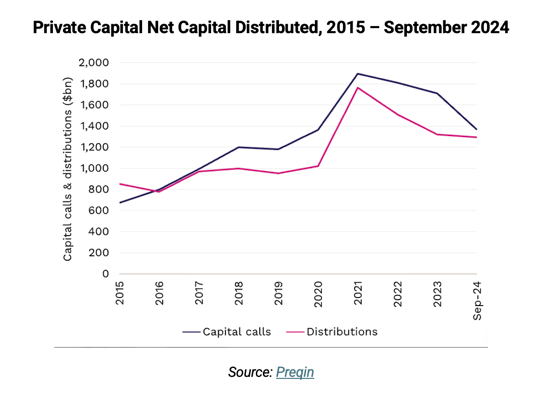

The Preqin chart below illustrates the difference between capital called by GPs near the start of the fund’s life cycle and returns distributed to LPs towards the end. The difference between the two gives us a reason for optimism, as the data shows that there may be more capital available for LPs to deploy in the months ahead.

Fundraising timelines lengthened again in 2025, reflecting a cautious investor base. Preqin reports that the median time to close a private equity fund is now 22 months, compared to roughly 16 months in 2020. Despite this, the number of funds in market has grown substantially, up more than 240% since 2020, suggesting that long-term appetite for the asset class remains strong.

Private wealth continues to emerge as a significant source of new commitments. Family offices, in particular, have increased their allocations to private markets by more than 500% since 2015, helping to bridge the gap left by slower institutional pacing.

If exit activity continues to improve in 2026, LP distributions are expected to increase, creating a cycle that supports new fund commitments. With ample dry powder and renewed investor confidence, fundraising could accelerate in the year ahead.

Looking ahead, several key trends are likely to shape middle-market private equity in 2026:

Middle-market private equity is entering a period of cautious optimism. GPs who prioritize portfolio company liquidity optionality, operational excellence, and proactive fundraising planning are likely to see the strongest results. LPs can expect gradually improving deployment opportunities, particularly as distributions from realized exits increase.

To learn more about our comprehensive service offering for private equity funds, visit our Funds Overview Page, or get in touch with Michael Von Bevern using his details below.

You can also view this article on Private Equity Wire.

Key Contact:

Michael Von Bevern

Michael Von Bevern

CO-MANAGING DIRECTOR, AMERICAS

View Bio | Email Michael | LinkedIn

Contrast

Contrast

Text size

Text size